Blog

From Transactions to Actions

Purpose-built for the interbanking flows

Unlock MT & ISO 20022 data for AI and BI

Powering Operations, Compliance, Treasury, Front Office.

Use Cases

Payments

- Structure and geolocate party data for accurate entity identification.

- Improve sanctions screening and fraud/AML detection.

- Forecast intraday cash from live transaction flows.

- Profile clients by activity, geography and counterparties.

Securities

- Extract complete agent details (roles, accounts, time zones, status).

- Group raw events into business-level transactions for clearer oversight.

- Create predictive features for failed trades and asset-servicing processes.

The Platform: TxFlow + TxAgent

- TxFlow

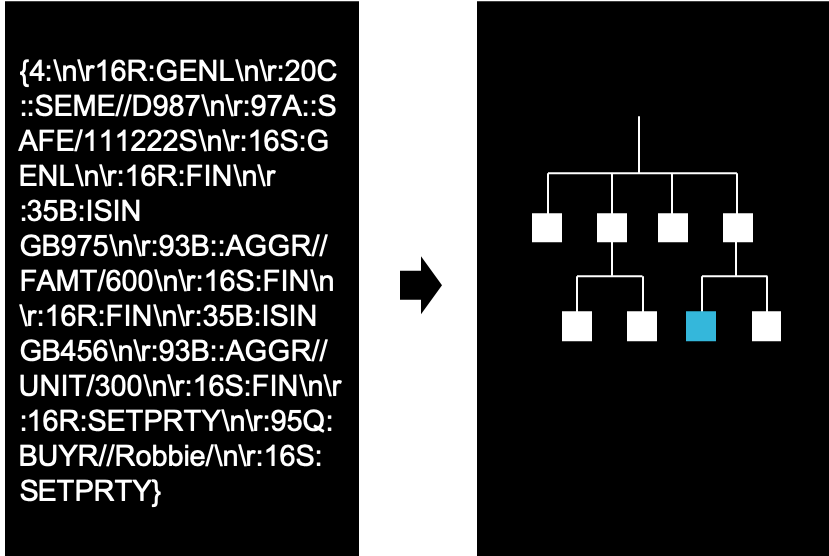

- Parse, enrich and structure SWIFT MT and ISO 20022 into AI/BI-ready models

- Process at scale with big data pipelines and aggregate flows over time

- TxAgent

- Query in plain English and explore flows and counterparties

- Build self-service reports or AI pipelines directly from interbank data

Cloud or On-Premises

- Deploy on Google Cloud (GCP/GKE) or your own infrastructure.

- Leverage planet-scale storage, processing and ML services.

- Enterprise-grade, production ready, fully supported.

Financial Messaging Data

- Input:ISO 20022 and SWIFT MT (ISO 15022) messages.

- Output: Nested JSON or tabular SQL, ready for analytics.

- Standardized: Documented models unifying entities, transactions, processes and flows.

- Rich:Information boosting artificial and business intelligence (AI/BI).

Partners

© Alpina Analytics 2025. Proudly Powered by WordPress